The Customs Union of Belarus, Kazakhstan and the Russian Federation

Author: Irina L. Vakhterova - the head of group legal consulting of Bar association Customs & Corporate Lawyers

"Good afternoon ladies and gentlemen. My name is Irina Vakhterov. I am the head of a group of legal consulting in the Bar" Customs lawyer. "As has been the name board, we are faced with customs issues on a daily basis. Questions, I think there are all importers , exporters and traders. But the purpose of my presentation today to tell what is happening within the Customs Union. As you know, there it is already more than a year in the legislation have been numerous developments. Today I want to tell you what happened, and what changes are prepared to you were prepared to wait for that and how to work in a new environment.

First I want to remind you of the purpose of the Customs Union.

The basic concept of the Customs Union, is the integration of the Eurasian Economic Community. Initially, it all started with the free trade regime, it is with the abolition of duties and restrictive trade measures, then the creation of the Customs Union and the ultimate goal - is to create a single economic space, involving the free movement of services, capital and labor.

What are the stages of formation?

Customs Union began, in fact, from January 1, 2010. As of that date were enacted Common Customs Tariff and a number of non-tariff regulation. That is, were adopted uniform rates of duty for the main categories of goods. The same key is July 1, 2011, since the forming of a single customs territory, as from 1 July 2011. Customs control is transferred to the external borders of the Customs Union. The final stage, the final planned transition to a single economic space, as I said, it is planned to implement by January 1, 2012.

Of course, now the work is the mass of documents, the mass of the agreements, you can go to the Common Economic Space. Because, as you know, the Common Economic Space is not only a custom, but the changes will affect fiscal, monetary and several other fields of law. Now all draft agreements that are being developed are consistent, they are all there to prepare for the January 1, 2012 now need to begin their study.

Currently, members of the Customs Union are three states - Russia, Belarus and Kazakhstan, but is considering expanding the Customs Union. For example, the Government of the Kyrgyz Republic signed a protocol on the beginning of the process of accession to the Customs Union.

Here, of course, it may be difficult, because Kyrgyzstan is a WTO member, because the tariff rates of customs duties are unified, of course, they are not quite coincident with the level of interest rates that are applied to the WTO. But this problem is solved and I believe that in the near future the Customs Union will consist of four states already.

Also addresses the issue of Ukraine's accession to the Customs Union.

The question, I think, is quite controversial and surely you and the press and on television and in the newspapers heard, saw and know that Ukraine is also a member of the WTO and is currently in serious negotiations with the European Union about the possibility of concluding an agreement on free trade zone. To date, this concept is joining the EU is crucial for Ukraine. But it is also considered and the possibility of joining the Customs Union.

In December last year conducted an international conference just in Ukraine dedicated to the Customs Union, and it was planned that we will discuss the questions of the participants of foreign economic activity, that is, simply import and export. But it turned out that most of the questions and economists and political scientists have raised about exactly how Ukraine should join the Customs Union, namely as a full member of the Customs Union. Opinions differed, but, probably, on any subject, there are supporters and opponents. Let's wait what will happen next, but in the near future are expected to sign an agreement on free trade with Ukraine. We hope that they will remain our partners and it is possible that on some other conditions may become members of the Customs Union.

Continuing on the existing Customs Union should be noted that, of course, the entry into force of the Customs Code, in principle, the functioning of the Customs Union, of course significantly changed legislation, in particular customs legislation.

From 1 January 2010 the unified customs tariff. From 1 July 2010, entered into force of the Customs Code of the Customs Union. Although the year has passed, a lot of questions and, unfortunately, how to apply the Code in practice is not yet entirely clear, although the legislation is unified, but a practice that has already been tried and tested by the customs authorities of the Member States of the Customs Union, to some extent continues persist because it is difficult to go directly to any new legislation. Of course, published a large number of regulations. Firstly, it is the decision of the Commission of the Customs Union, which are mandatory for members-states of the Customs Union, but also regulations on the level of national regulation. Some questions of the Customs Code of the Customs Union referred to the national regulation and are already issued orders, instructions, FCS, which, in fact, explain the customs legislation, in particular the Customs Code of the Customs Union. But our experience shows that one and the same rule is interpreted in different states of the Customs Union in different ways and this causes it to practical problems that face again, importers and exporters.

On December 29, 2010 came into force the Law "On Customs Regulation in the Russian Federation." In fact, any new rules, it is not set, that is only defines some things that are really attributed to the level of control of the national legislation.

Until now, published a sufficient number, and signed the Customs Union agreement on tariff and non-tariff regulation. I will not dwell on these agreements, since they are all published and can be found on the website of the Commission of the Customs Union, to read them. Moreover there already is and regulations that have been adopted in the framework of these agreements and they systematically enough.

What has changed with the start of the Customs Union? As I have said, was adopted by the Common Customs Tariff of the Customs Union, which means, in effect, the unification of import duties.

These rates are classified in accordance with the commodity nomenclature of foreign economic activity. Thus, in all countries use the commodity nomenclature of foreign economic activity of the Customs Union on the basis of which to develop uniform tariffs with standardized rates. While not all goods are unified rates, but certainly by 1 July 2012 will complete unification, since it is assumed already the launch of the Common Economic Space.

With regard to non-tariff regulation.

The main areas affected detailed, it is a technical regulation, licensing, sanitary measures, veterinary and plant quarantine measures. Once again, that all agreements on non-tariff measures published and made available. I want to tell only about the concept according to which regulated non-tariff measures.

So, from July 1, operates an alternative basis for the use of non-tariff regulation. What does this mean? This means that is applied as a national regulatory regime and a single mode control. This means that within the framework of the Customs Union, of course, non-tariff measures should be uniform, but by July 1, 2010, Member States of the Customs Union were not quite ready to apply the same standards to technical regulations, technical regulations.

Currently, there are technical regulations, approved by national authorities, and they will be in effect until the entry into force of the Union technical regulations. And now, as far as I know, not finally approved yet no technical regulations of the Customs Union, many of them are still in the development stage and at the stage of public discussion. Accordingly, a single mode of customs regulation and involves the issuance of common forms of certificates in accordance with the declaration of conformity. Agreement exists already exist certification bodies that are accredited and is authorized to issue a single certificate. But then again left to wait, when will come into force and technical regulations already on the non-tariff regulation will not have any additional questions.

As shown by practical experience in the functioning of the Customs Union, unfortunately, there are some drawbacks.

Specialists, experts came to the conclusion that after all the Customs Code of the Customs Union needs work, needs work agreement "On the determination of the customs value of goods transported across the customs border of the Customs Union" and a number of agreements. This is a natural process, since only in practice can be understood, and how to apply the theoretical rules that have been spelled out in the Customs Code and a number of fairly important agreements. Moreover it was found out that it is extremely necessary to develop additional documents, as not all issues that at first glance would seem to have to practice for a long time used, can be resolved under the laws of the Customs Union.

For example, there are many issues associated with bringing to justice, as administrative rules are now being applied in national legislation. But given that there is one rule that on traders to import and export, respectively, then, in fact, have to some extent be harmonized rules related to potential liability. Moreover, now in the project, the development is the agreement "on a single form of invoices" that in principle further in an already functioning single economic space and harmonization of tax legislation should make life easier, both importers and exporters.

When we talk about that in the framework of the Customs Union should happen complete unification of the law, it is assumed that there is a single territory on which to apply a uniform rule. But I must say that even those agreements that are now taken in the development of the Customs Code, on the decisions of some commissions, they are not always focused on the unification. I think all of you are faced with the question of classification of goods, ie goods correlation to a specific code of the Commodity Nomenclature.

As I said, there is a single customs tariff and a common nomenclature of the Customs Union. But what happens classification by the customs authorities and only those authorities may exercise its goods and relate to one category or another. According to the idea of the same goods in the Customs Union should be classified in the same position, but in practice is completely different and, furthermore, decisions taken authority of a State shall not apply to other states. Case study - if, say, there is a foreign exporter, which supplies both in Russia and Kazakhstan. In this case, when importing goods in Russia is classified a code that corresponds to the duty rate of 10%, while in Kazakhstan this product is classified by other code, which corresponds to the rate of 5%. Themselves know perfectly well that this product comes to the common market and are traded on this market generally. Then the Russian company is losing competitiveness due to the fact that the rate is higher. Unfortunately, this issue is not yet resolved, although as far as I know, the Customs Union Commission is now planning to make changes to the appropriate decision to this issue still to be addressed.

Of course, this classification is a serious topic. Problems such as existed before the Customs Union, so unfortunately they are now.

Problems related to the allocation to the different codes of the commodity nomenclature, with inflated rates of customs duties, which reduces the competitiveness of goods on the domestic market.

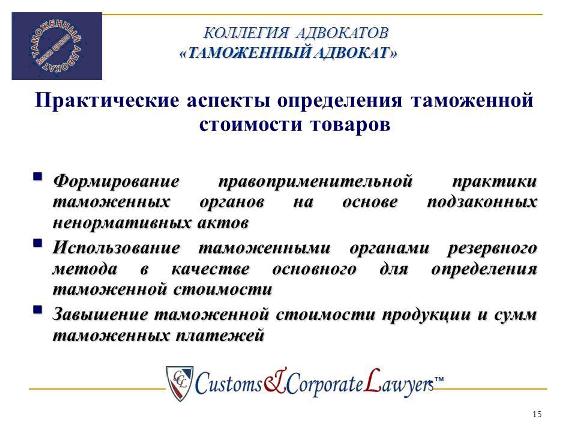

Extremely important issue is the definition of the customs value. Since July 1 agreement came into force "On the determination of the customs value of goods transported across the customs border of the Customs Union."

Unfortunately, law enforcement practice under the new law, in fact, is not formed, and I think you have to wait about six months to see how the new legislation will affect law-enforcement practice. What was before July 1, from practice, disputes relating to the customs value adjustments were considered by 80% towards the traders. What happens next is hard to say, because the process of adjustments, adjustments to the appeal process long enough. Let's wait, let's see.

What has changed on the customs value? I think it will affect large manufacturing companies, which, for example, here are its subsidiaries.

Under the agreement, the method according to the transaction value of the imported goods, that is a key first method can be used only if the supply is between related persons, if the declarant proves that this relationship did not influence the value of the transaction. To prove he can only if present evidence that its value is close to one of the screening values. What is a catch is? Previously, under the laws of the declarant had the right to do it. According to the agreement "On the determination of the customs value of goods transported across the customs border of the Customs Union" declarant shall do it. Accordingly, in practice, the following happened that most of the companies, for example subsidiaries of large foreign manufacturers have lost the opportunity to use the first method in practice. But we note that still preparing positive changes in legislation, as experts already know that there are a number of flaws. Now under negotiation is a protocol that approves draft amendments to the agreement and the problem is resolved.

It should be noted that, indeed, in spite of some errors that were made, now legislation is still moving forward and I hope that in the near future problems faced by exporters and importers will be resolved at the legislative level, but if in law does not work, then unfortunately, remains the only way - the court".